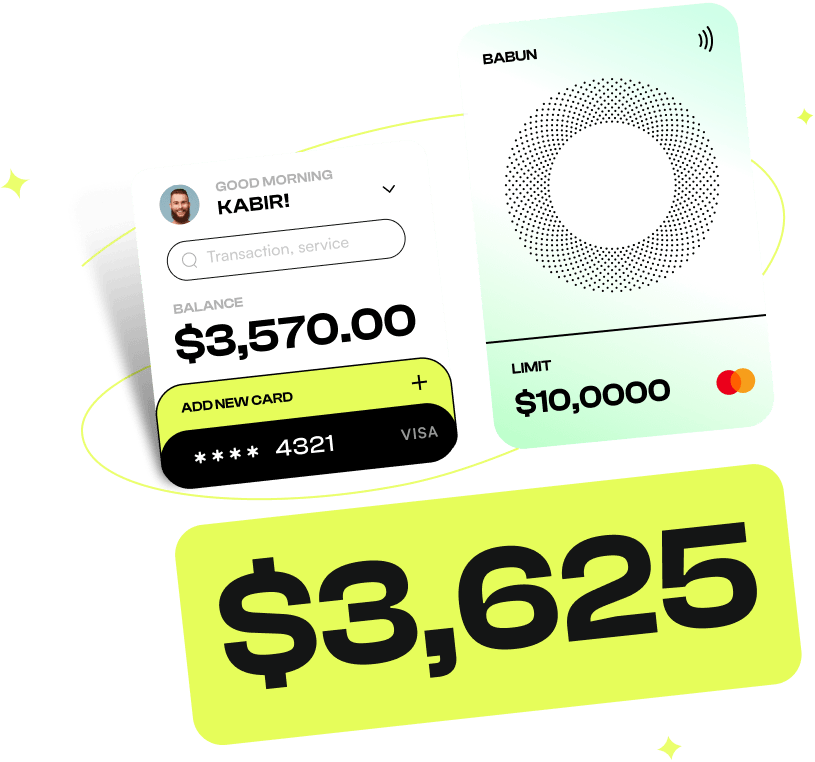

All Your Financial Needs.

Biplify offers a complete suite of financial tools for individuals and businesses.

Apply NowVisa

Create virtual Visa cards for secure online payments and subscriptions.

Mastercard

Issue Mastercard virtual cards for your international and local transactions.

Our Core Services

Everything you need to manage your finances in one place.

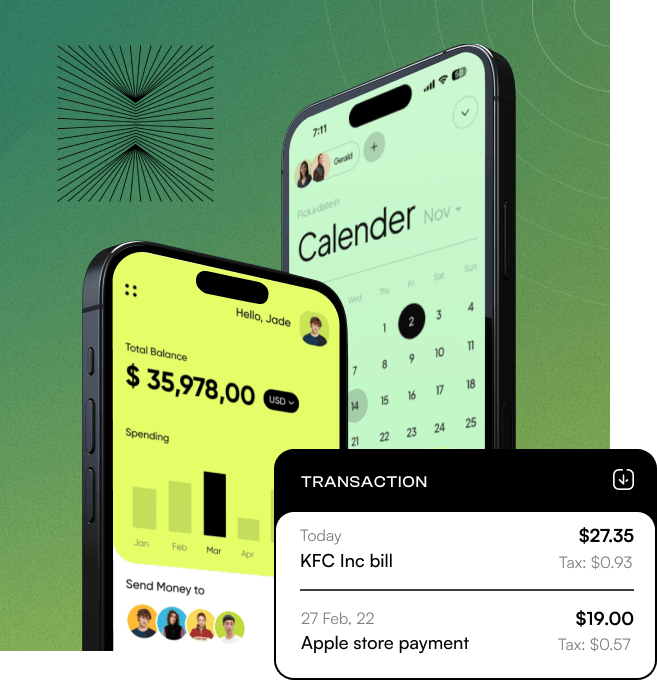

Time is money. Save both.

We offer an API service for developers to integrate with our platform. Easy-to-use corporate cards, bill payments, accounting, and a whole lot more. All in one place.

- Mobile app easy management & access.

- Ton’s of features for handle the card easily & safely

- Strong security system.

Instant Transfer - Free

0% charge for online money transfer from you wallet instant.

Google & Apple pay

Pay google & apple payment with your card without any hassle

Top Security

World-class security that makes your money safe & secure.

Get Started in 3 Easy Steps.

Sign up in minutes with a simple verification process. Get instant access to your multi-currency wallet.

Easily add funds to your wallet via bank transfer or card. Instantly create virtual USD or Naira cards for your needs.

Use your virtual cards for online shopping, subscriptions, and international payments. Pay bills and manage your finances with ease.

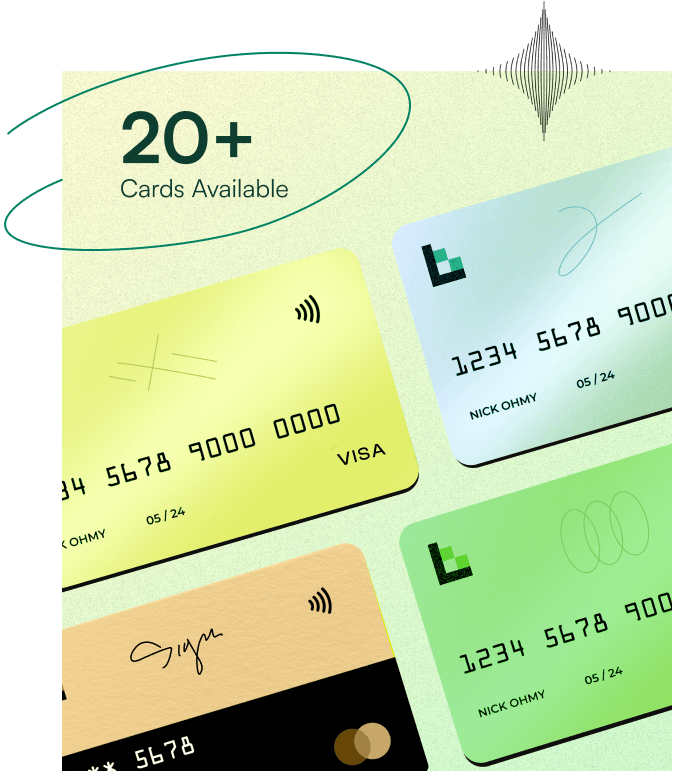

Get a global bank account

Get a bank account in just minutes. Receive and access your global payments whenever you want to.

Get It Now

International Multi-Currency Visa & Master Card.

International banking provides global financial services, including cross-border transactions, currency exchange, and offshore investments.